Although HELOCs want inspections may vary with respect to the bank plus the specific facts

Perform HELOCs Wanted Monitors?

Even though some lenders may well not want monitors certainly HELOCs, it is common to allow them to request an assessment and you may, in many cases, a house inspection.

The choice to wanted inspections is usually considering products such due to the fact amount borrowed, the house method of, and borrower’s creditworthiness. Lenders fool around with checks to guard its investment and ensure your home is appropriate collateral on mortgage.

To decide if or not a certain HELOC need inspections, individuals should consult with its lender or opinion the mortgage standards and you can assistance. It’s very important to know brand new lender’s standards and you will follow people inspection demands in order to helps this new HELOC techniques.

Basically, monitors enjoy an essential role from the HELOC techniques. They provide an accurate evaluation of your own property’s worth, identify potential things, which help mitigate bank chance. When you are checks may possibly not be necessary for all the HELOCs, borrowers should be happy to go through an appraisal and you will probably good household inspection included in the mortgage techniques.

Reasons for having Monitors

Inspections gamble a crucial role in the process of obtaining a great Family Guarantee Credit line (HELOC). This type of checks suffice a number of important motives one work for the borrower additionally the lender.

Assessing Worth of

One of the primary things about checks in the context of HELOCs would be to measure the property value the home. Loan providers have to determine the modern market value of the house to select the restriction amount which are often lent facing they. It valuation support introduce the loan-to-worth (LTV) ratio, which is an important facet during the choosing the level of credit available to this new borrower.

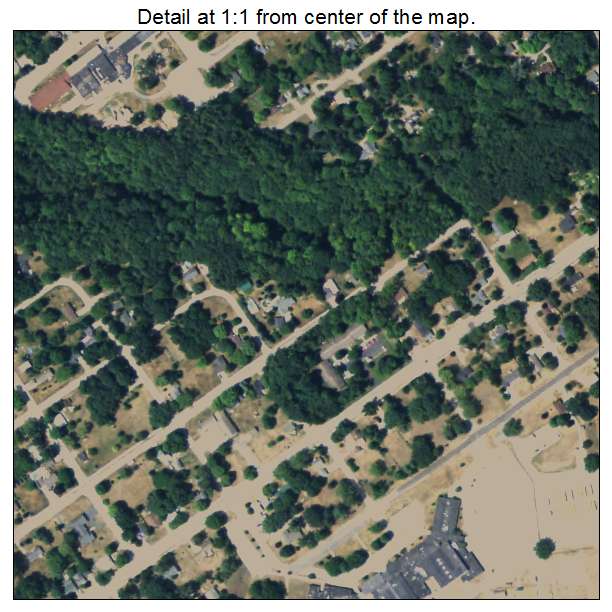

When you look at the appraisal process, a professional appraiser commonly check out the assets and you can evaluate various points such as place, size, position, and equivalent sales in your community. The latest appraiser will then promote a projected value of the house, that will help the lending company dictate the loan number and this can be available to brand new debtor.

Determining Possible Circumstances

Inspections having HELOCs and additionally serve the intention of distinguishing prospective affairs or risks on the assets. This is important for both the debtor plus the bank. Identifying people items beforehand might help avoid unexpected surprises and make certain that possessions fits specific standards.

A comprehensive domestic check is generally held to evaluate the general reputation of the house. So it review talks about section for instance the architectural integrity, electricity expertise, plumbing work, hvac possibilities, and other key elements of the property. Any potential things otherwise issues located from inside the inspection can be handled in advance of signing the borrowed funds words.

Mitigating Lender Exposure

Inspections to own HELOCs together with serve to decrease exposure with the bank. Because of the performing thorough inspections, loan providers is choose any possible risks from the possessions you to can affect its worthy of otherwise marketability. It will help lenders generate advised conclusion regarding the loan terms and conditions and you will decreases the odds of default or losings.

Mitigating chance as a result of inspections is very very important to lenders because the a great HELOC is a kind of revolving borrowing from the bank covered by assets. The lender has to make sure the property used since security is actually great condition and also sufficient worth to guard its financial support.

Of the assessing the property worth, identifying prospective affairs, and you will mitigating lender exposure, inspections gamble a crucial role regarding the HELOC techniques. This type of inspections provide beneficial guidance so you can each other consumers and you will loan providers, ensuring that the property is suitable once the guarantee and that all of the activities in it is actually safe.

Particular Monitors

With regards to HELOCs (Home Guarantee Credit lines), all sorts of monitors may be needed to evaluate the new property’s really worth and you can select potential products. Let us explore three prominent style of monitors which might be often associated that have HELOCs: property assessment, house examination, or any other checks.