Why does credit debt forgiveness impression the fees?

That have persistent rising prices and you will increasing interest rates dogging consumers into the latest decades, People in america today face over $step one trillion inside the credit card debt. The typical Western now owes as much as $8,000 during the personal credit card debt .

That’s not a cost extremely property can also be pay back rapidly, particularly if you hold an equilibrium and should spend nice interest costs. According to the Federal Set aside, the typical charge card interest rate enjoys skyrocketed out of % for the 2021 so you’re able to their current speed out-of %. Tough, a recent Consumer Financial Security Bureau (CFPB) statement discovered that 15 playing cards out of nine of your own largest issuers costs cardholders yearly commission costs (APRs) more 31%.

In the midst of these scenarios, they shouldn’t be alarming that numerous cardholders struggle to maintain with their money. To that avoid, 30-time delinquency rates struck step 3.25% about second one-fourth out-of 2024, ascending toward 11th consecutive quarter.

If the credit debt is located at a dangerous level, consider carefully your selection, and debt consolidation , a home equity financing and you can credit guidance. If you have currently overlooked money and you are clearly staring at personal bankruptcy or almost every other more serious choices, personal credit card debt forgiveness -otherwise debt settlement-s discuss together with your loan providers in your stead to lessen your obligations that assist you deal with it finest. In advance of continuing, yet not, it’s required to think just how bank card forgiveness you’ll impression the fees.

Why does personal credit card debt forgiveness impact the taxes?

Seeking bank card forgiveness as a result of a debt relief solution may help your decrease your loans by allowing you to definitely pay just a good portion of what you owe. web sites Think about, although not, that the Irs adds people forgiven obligations to the income.

“You will find limited exclusions, but the majority loans agreements are believed taxable,” states James Guarino, CPA and you may controlling movie director on Baker Newman Noyes inside Woburn, MA. “It means this new part of the personal debt forgiven try reported on the their tax return while the a lot more average money, and it may be subject to federal taxation at the rates between ten% so you’re able to 37% having 2024, depending on your income tax bracket.”

The quantity you might owe the newest Irs to have credit card forgiveness utilizes the tax bracket. The higher your own tax class, more you will buy one forgiven financial obligation. Like, should you get a good $ten,000 credit card debt relief, along with your earnings places your regarding 20% taxation group, you’d are obligated to pay $2,000 within the government taxes on your forgiven loans.

If you’re considering tackling the credit card debt because of a settlement, you will need to declaration it and you can get ready for the fresh new tax bill ahead. “You should be happy to report one personal debt that’s forgiven while in the taxation seasons,” claims Alex Beene, a monetary literacy instructor at University of Tennessee within Martin. “This can generally come in the form of an effective 1099-C on the facilities that forgiven your debt. This is exactly one of the biggest errors I’ve seen specific create. They won’t prepare for this, and thus, they find themselves with more substantial goverment tax bill and you can an inability to pay they.”

Whom should think about bank card forgiveness?

Debt settlement has the benefit of a possible choice to lower your credit card obligations, which could simplicity the stress on the finances. But, such personal bankruptcy, this one will likely be given serious attention as it could adversely connect with your credit score .

Just like the Melissa A. Caro, CFP and you can maker off My Retirement Community inside New york, cards, “Debt relief are a past hotel immediately after exploring selection including financial obligation combination, credit counseling otherwise negotiating physically with loan providers. But when you possess a lot of consumer debt-such as for example handmade cards-can’t see minimum payments and you will would even feel potentially against personal bankruptcy, upcoming settlement might have a shorter big affect your borrowing from the bank score and you can financial upcoming than just ages your credit score and can even perhaps not get rid of the whole loans.”

The bottom line

If you choose to follow charge card forgiveness as a result of a debt settlement, anticipate to pay the taxes. “While you are against a supplementary tax weight out-of debt settlement, both essential products should be document every piece off documents on the forgiveness processes and you will speak to a taxation advisor to evaluate what your payments will appear instance and the ways to best outlay cash back,” states Beene.

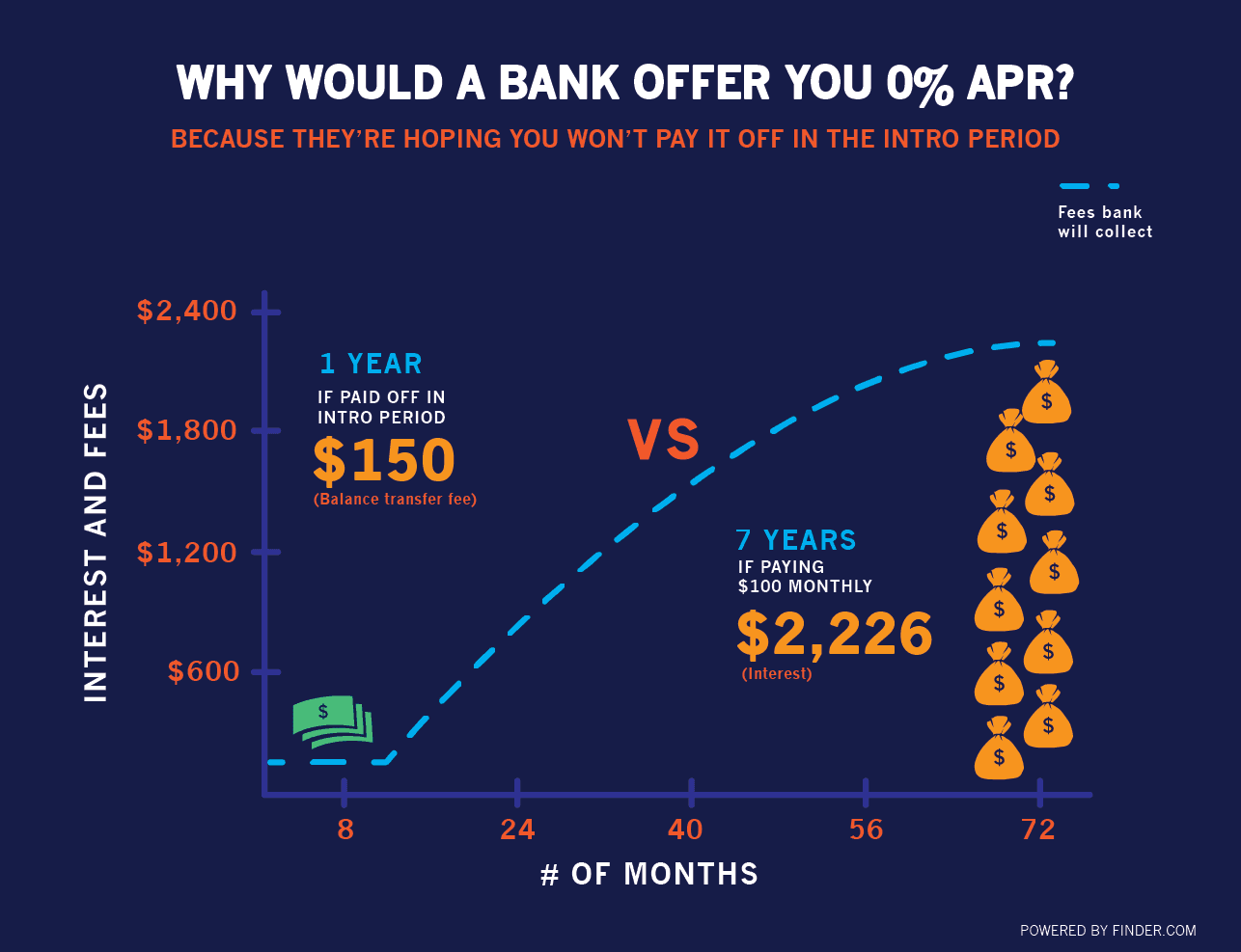

While you are concerned your own personal credit card debt is unsurmountable, speak about all of your options, and debt consolidation reduction loans and you can 0% equilibrium import playing cards . Although not, if you don’t right the fresh new routines that lead to your debt, you could end up with financial obligation, putting some problem worse. It’s adviseable to imagine working with a card counselor who can help you developed a propose to repay your own loans.